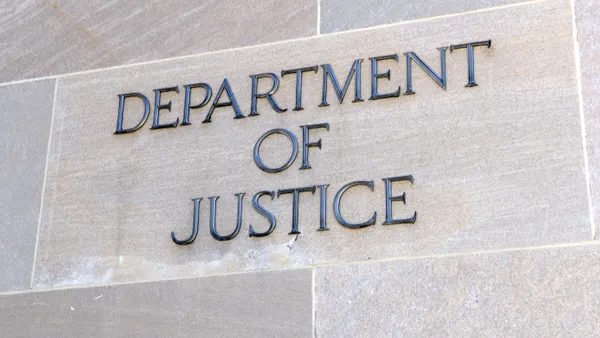

A provider group has prevailed in the latest in a string of lawsuits against the federal government over how regulators interpreted the No Surprises Act in creating a dispute resolution process for insurers and providers at odds over out-of-network medical bills.

The lawsuit hinged on wording in final rules implementing the No Surprises Act instructing arbiters to first consider an insurer-set metric called the qualifying payment amount, or QPA, in deciding a payment amount for providers.

The Texas Medical Association sued the government in September 2022, arguing that provision unfairly advantaged health insurers. A district court ruled in favor of the TMA in February 2023, vacating QPA instructions and remanding the rule back to the government for revision. That decision sparked an appeal from the Biden administration.

On Friday, the 5th Circuit Court of Appeals upheld the lower court’s ruling, finding the government infringed on arbiters’ discretion to balance other factors along with the QPA as they choose.

It’s unclear whether regulators will have to pause the dispute resolution process to revise the rules to align with the court’s decision, though that seems likely. The HHS, which has yet to update its notice page for No Surprises, did not respond to a request for comment.

The TMA is behind a number of lawsuits over how the HHS and other agencies implemented the No Surprises Act passed in 2021.

The law, which went into effect early 2022, protects consumers from unexpected medical bills after receiving out-of-network care at an in-network facility or other surprise situations. It does so by holding them blameless for any charges, and requiring insurers and providers to decide how much the provider should be reimbursed for a member’s care.

The law created a framework for negotiations called independent dispute resolution, or IDR, if payers and providers can’t reach a decision themselves. Each side submits a payment offer to a third-party arbiter, who then picks one of the two amounts.

Providers quickly cried foul, arguing the rules implementing No Surprises were tilted in favor of insurers by relying too heavily on the QPA. The QPA is meant to represent the median in-network charge for a service in a specific geographic area, but providers argue it’s an arbitrary metric set by insurers at low rates to try to reduce reimbursement.

How heavily the QPA factors into the dispute resolution process has been at the center of multiple suits against the government — including this one in the markedly anti-big government 5th Circuit Court of Appeals.

In it, the TMA argued that regulators didn’t implement No Surprises as Congress intended by requiring arbiters to consider the QPA first in determining a payment. That decision put a thumb on the scale in favor of the QPA over other factors, like a doctor’s experience or the sickness of the patient, according to the lawsuit.

The medical association was joined by Tyler Regional Hospital in Texas and a physician from the state, along with two air ambulance providers, LifeNet and East Texas Air One, as plaintiffs.

The Biden administration defended their reading of the statute as accurate, while arguing the plaintiffs didn’t have standing to bring the case.

However, the 5th Circuit’s three-judge panel on Friday agreed with the TMA that the final rules implementing No Surprises conflict with the law.

No Surprises gives the agencies permission to establish an independent dispute resolution process, not fill in the gaps of the process with guidelines that independent arbiters must follow, according to their opinion.

“Nothing in the Act instructs arbiters to weigh any one factor or circumstance more heavily than the others,” the judges wrote. “The Final Rule therefore exceeds the Departments’ authority.”

The TMA said it was pleased with the court’s decision in a statement on Monday.

“Tilting the scales in this manner was unfair to physicians, providers, and the patients we care for,” the group said. “We hope this resolves the issue once and for all ... The federal agency rules must adhere to the law and cannot privilege the qualifying payment amount.”

It’s the second of four lawsuits filed by the TMA looking to reshape how federal agencies interpreted No Surprises. The group has taken issue with regulators raising the cost of initiating IDR, whether claims can be tied together during the process, how much QPA factors into arbitration and how provisions in rulemaking unfairly lower QPAs. The federal government appealed the latter suit, which is also pending in front of the 5th Circuit.

Courts have generally agreed with the TMA, which is the largest state medical society in the nation — and one of the most litigious, at least when it comes to No Surprises. The TMA has won or partially won all four lawsuits.

As a result of the suits, regulators have had to pause and restart the dispute resolution process multiple times over the last two years. That’s contributed to a backlog in claims, putting more stress on the IDR system. Regulators say they’re facing a growing mountain of disputes, after receiving more requests for arbitration than anticipated.

The federal government received 13 times more surprise billing disputes in the first half of 2023 than it expected to receive in a full year, according to data released in February.

Providers have won more than three-fourths of payment determinations, a statistic the industry points to in arguing that insurers lean on the No Surprises process to offer artificially low rates. Providers have also accused insurers of delaying awards — or not paying them altogether — owed to providers following arbiters’ decisions.

Meanwhile, insurers say a small group of providers are filing large numbers of disputes to try to profit from IDR now that they can no longer balance bill patients.

Despite provider and insurer squabbling over the minutiae of the process, data suggests the law has improved the situation for patients. More than 10 million surprise bills were prevented in the first nine months of 2023 because of No Surprises, according to an analysis by health insurance groups.